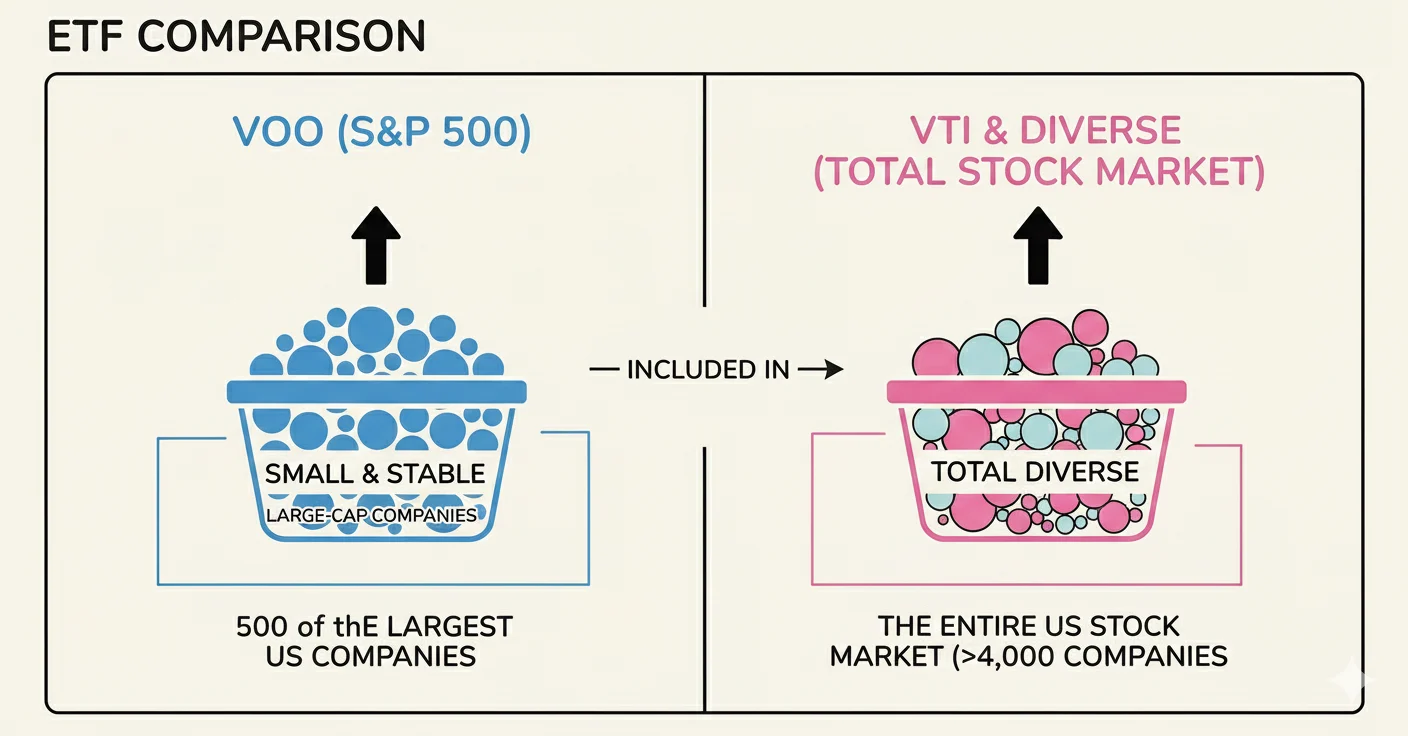

f you wonder “VOO or VTI?”, here’s the simple gist:

- VOO tracks the large-cap 500 biggest U.S. companies. Great for stable, large-company exposure.

- VTI covers the entire U.S. stock market — large, mid, small, and even micro-cap companies. Broader diversification.

- In short: VOO = large-cap focused; VTI = full market exposure. Choose based on whether you want focused stability or broad diversification.

Choosing between VOO or VTI is one of the first questions new investors ask. Both look similar. Both come from the same company. Both are low-cost and popular. And both invest in U.S. companies.

So it’s natural to feel confused.

But don’t worry — this guide breaks everything down in simple, class-4-friendly language. No complex finance terms. No confusing jargon. Just clear explanations, examples, and easy tips that anyone can understand.

By the end, you’ll know:

- What VOO means

- What VTI means

- The main difference

- When to use each

- Easy memory tricks

- Common mistakes to avoid

- Which one might fit your investing style

Let’s start simple.

What Does Each Fund Mean?

Even though “VOO” and “VTI” sound similar, they are actually very different.

What Is VOO? (Easy Definition)

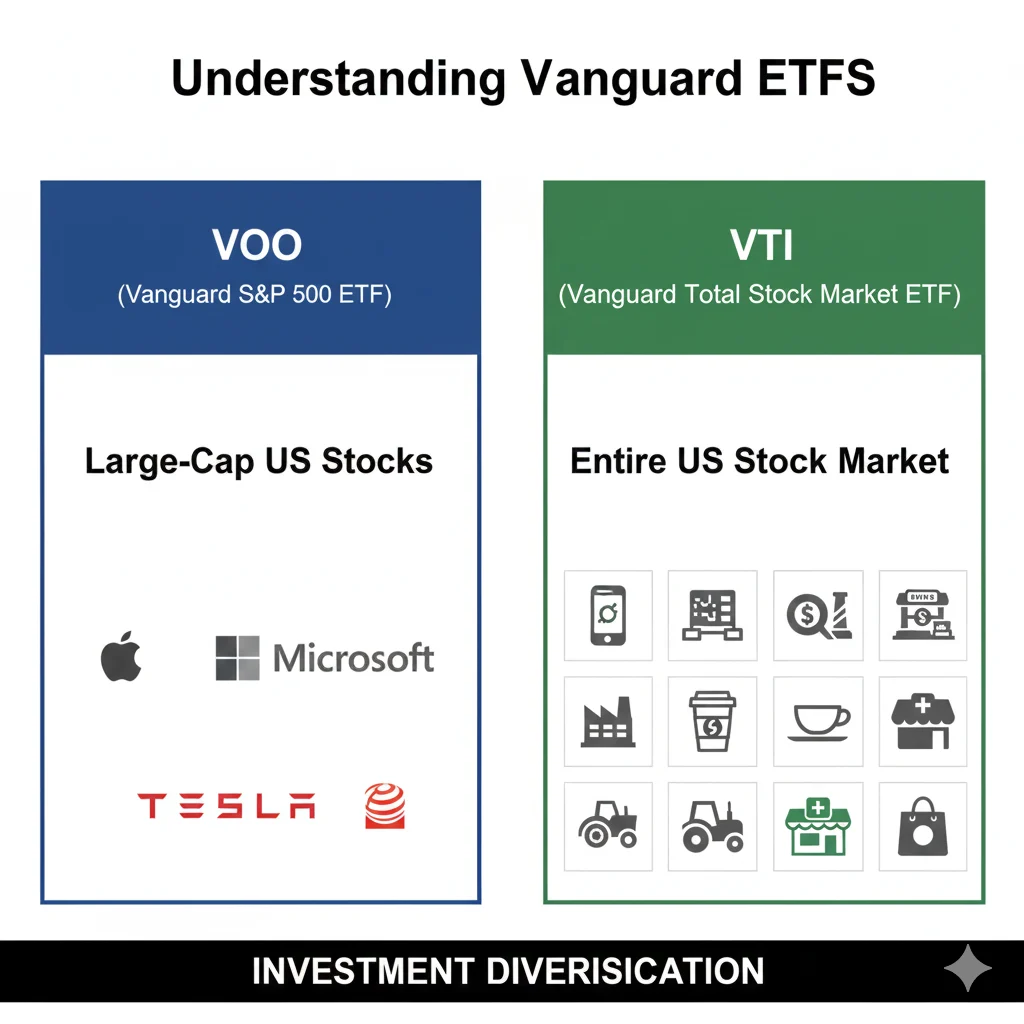

VOO is an ETF (a basket of stocks) that holds only the 500 largest companies in the United States.

Think of it like picking the top 500 biggest, strongest players on a sports team.

Key Points About VOO:

- Only large, well-established companies

- About 500 stocks

- More stable because big companies move slower

Simple Examples:

- “VOO invests in big companies I already know.”

- “I use VOO when I want my money in large, strong businesses.”

- “VOO feels safer because it avoids small risky companies.”

What Is VTI? (Easy Definition)

VTI is an ETF that holds almost every U.S. company — big ones, medium ones, and small ones.

Think of it like hiring every player on the field, not just the top 500.

Key Points About VTI:

- Over 3,500 companies

- Includes small and mid-size businesses

- More diversified, but slightly more risky

Simple Examples:

- “VTI gives me a piece of the whole U.S. stock market.”

- “I use VTI when I want more companies in my portfolio.”

- “VTI includes rising-star companies that might grow fast.”

The Key Difference Between VOO and VTI

Here is the simplest way to understand VOO vs VTI:

👉 VOO = only big companies

👉 VTI = all companies

That’s it.

Now let’s see it in a table.

Comparison Table: VOO vs VTI

| Feature | VOO | VTI |

|---|---|---|

| Number of Stocks | ~500 | ~3,500+ |

| Types of Companies | Large-cap only | Large, mid, small, and micro-cap |

| Risk Level | Lower | Slightly higher |

| Diversification | Medium | Very high |

| Best For | Stability | Full market exposure |

| Example Story | Choosing the biggest, strongest 500 players | Choosing every player, big or small |

⭐ Quick Tip to Remember:

VOO = “Very Only Outstanding companies” (big ones)

VTI = “Very Total Index” (the whole market)

Common Mistakes and How to Avoid Them

Many people mix up VOO and VTI because they sound alike or because both include big companies. Here are the most common mistakes.

❌ Mistake 1: Thinking VOO and VTI are the same

They are NOT.

✔ VOO has only big companies

✔ VTI has big, medium, and small companies

Correct Thought:

“They share many big companies, but VTI has many more smaller ones too.”

❌ Mistake 2: Thinking more companies always means better results

More companies also means more small stocks… which can swing more.

Correct Thought:

“VTI gives more chances to grow, but also more ups and downs.”

❌ Mistake 3: Choosing based only on past returns

Past performance changes every year.

Correct Thought:

“I should choose based on my comfort level and goals, not just last year’s chart.”

When to Use VOO

Choose VOO when you want:

- More stability

- Less movement during market drops

- Only large and strong American companies

- A simple, safe-feeling investment

Easy Example Sentences:

- “I want stable growth, so I picked VOO.”

- “VOO feels safer because it avoids small risky companies.”

- “My long-term plan includes VOO for steady performance.”

- “If the market falls, large companies in VOO may hold up better.”

- “I use VOO when I want simple and dependable investing.”

Memory Hack:

Think of VOO as a big tree with thick branches — strong and stable.

When to Use VTI

Choose VTI if you want:

- The entire U.S. stock market

- More variety

- Big, medium, and small stocks

- Higher long-term growth potential

Easy Example Sentences:

- “I want every type of company, so I use VTI.”

- “VTI helps me invest in rising young companies.”

- “I like maximum diversification, so VTI is perfect.”

- “I use VTI when I want both safety and growth.”

- “VTI spreads risk across thousands of companies.”

Memory Hack:

Think of VTI as a giant forest with all kinds of trees — big, medium, small.

Quick Recap: VOO vs VTI

- VOO = top 500 biggest companies

- VTI = nearly all U.S. companies

- VOO is more stable

- VTI is more diversified

- VOO = safer feel

- VTI = broader exposure

- Both are excellent for long-term investing

Advanced Tips

✔ 1. Origins

Both are index funds designed to track U.S. markets without human stock pickers.

✔ 2. Formal Usage

When writing essays or financial reports:

- “VOO represents large-cap exposure.”

- “VTI offers total-market representation.”

✔ 3. Online Misuse

People often say “VTI always wins because it’s bigger.”

Not true.

Small caps rise fast and fall faster.

The right choice depends on:

- Time horizon

- Risk comfort

- Investment goals

Mini Quiz (with Answers Below)

Fill in the blanks with VOO or VTI.

- I want the entire U.S. market, so I choose ___.

- I want large stable companies only, so I choose ___.

- ___ includes small and medium companies.

- ___ holds about 500 big companies.

- For maximum diversification, I use ___.

- If I prefer less movement, I pick ___.

- For rising small companies, ___ is better.

Answers:

- VTI

- VOO

- VTI

- VOO

- VTI

- VOO

- VTI

5 Important FAQs About VOO or VTI

1. What is the difference between VOO and VTI?

VOO focuses only on the biggest companies, while VTI invests in the entire U.S. market — large, mid, small, and micro companies.

2. Which is better: VOO or VTI?

Neither is “better.” VOO is more stable; VTI is more diversified. Choose based on your goals.

3. Is VTI riskier than VOO?

A little, yes. VTI includes small companies that move faster, up and down.

4. Can I invest in both?

Yes! Many investors mix both for balance.

5. Which should beginners start with?

Beginners who want simplicity choose VOO.

Beginners who want full market exposure choose VTI.

Conclusion

Now you clearly understand the difference between VOO or VTI.

Both are powerful, simple, and smart choices for long-term investing.

Use VOO when you prefer the safety and strength of large companies.

Use VTI when you want the whole market and more diversification.

No matter which one you choose, the most important step is to start investing and stay consistent. Every small step builds your future.

Mira Loxley is a passionate language and writing expert at Definevs.com, turning tricky words and grammar into clear, engaging guides for every reader.