Ever looked at a balance sheet and wondered, “Is accounts receivable a debit or credit?” 🤔

You’re not alone! This is one of the most confusing topics in basic accounting and bookkeeping.

Many students and small business owners mix them up — but once you understand the logic behind it, it becomes super simple.

In this article, we’ll explain:

- What accounts receivable means

- Whether it’s a debit or a credit (and why)

- The difference between debit and credit

- Simple examples and memory tricks

- Common mistakes to avoid

By the end, you’ll never be confused again when someone asks, “Is accounts receivable a debit or a credit?”

📘 What Does “Accounts Receivable” Mean?

Let’s start with the basics.

Accounts Receivable (AR) means money owed to your business by customers who bought something on credit.

It’s what your business is waiting to receive in the future — like an unpaid invoice.

👉 In simple words:

When your customer says, “I’ll pay you later,” that amount becomes your accounts receivable.

🧾 Example:

- You sell goods worth $1,000 to a customer.

- The customer promises to pay next month.

- Until then, that $1,000 is your accounts receivable.

So, accounts receivable represents money that’s coming in — not money you owe.

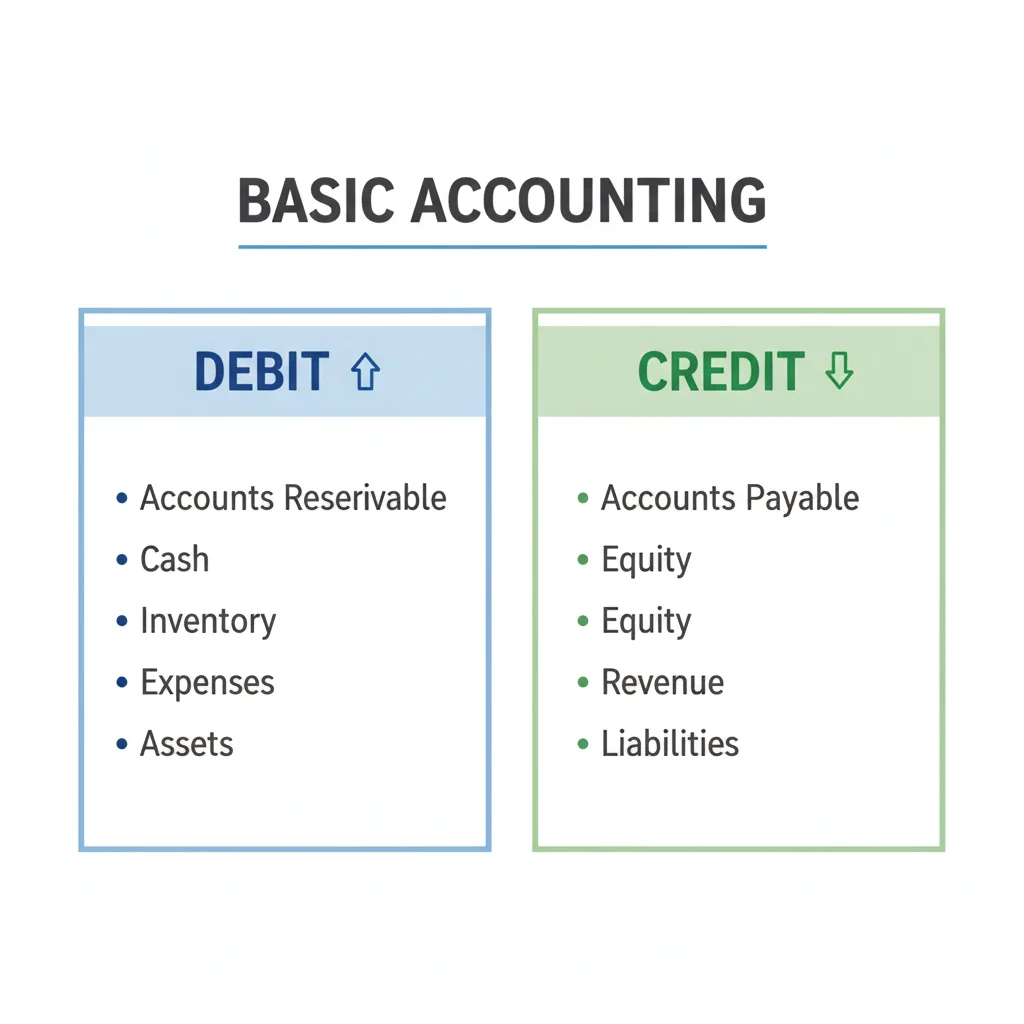

💡 Debit vs Credit: A Simple Explanation

Before we decide if accounts receivable is a debit or credit, let’s quickly understand what debit and credit mean in accounting.

| Term | Meaning | Example | Effect on Assets |

|---|---|---|---|

| Debit (Dr) | Increases assets or expenses | You receive cash or goods | Asset goes up |

| Credit (Cr) | Decreases assets or increases income/liabilities | You owe someone or earn revenue | Asset goes down |

💭 Think of it like this:

- Debit = money coming in

- Credit = money going out

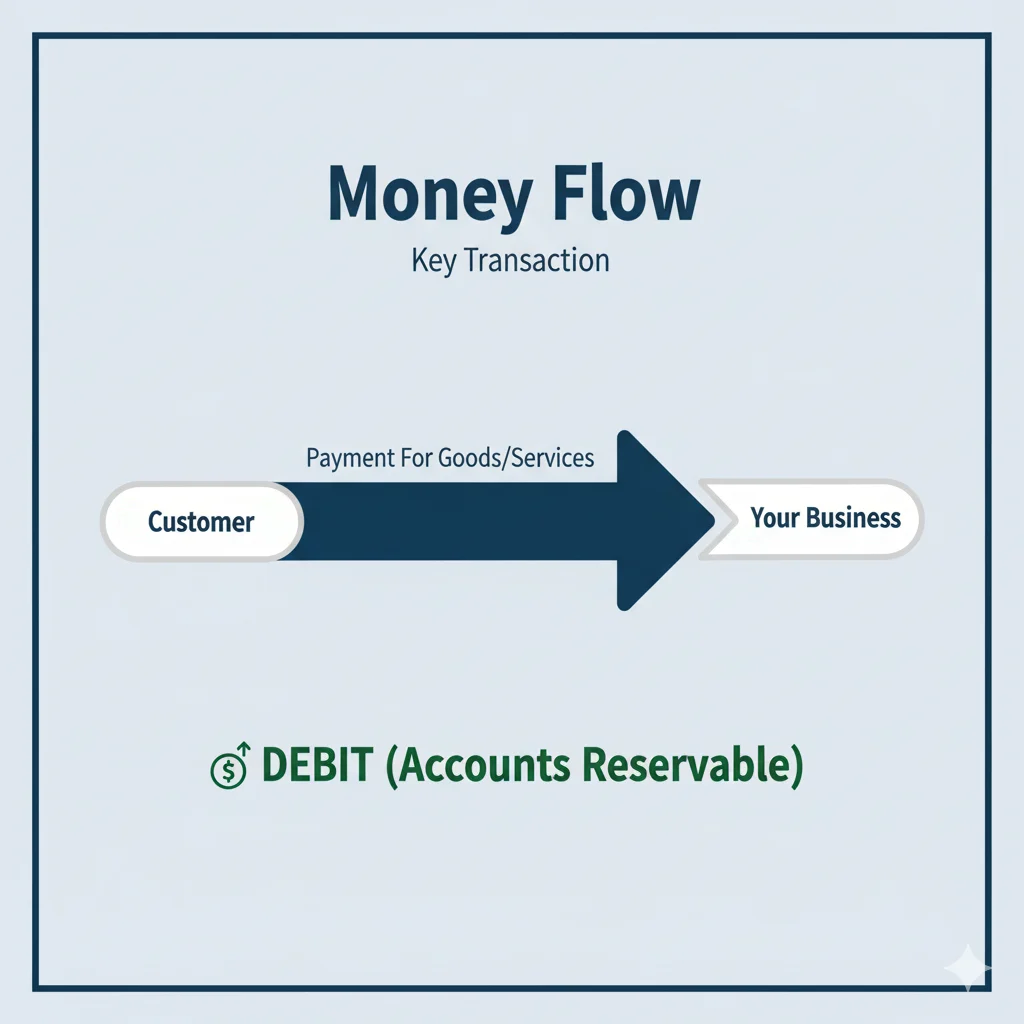

🏦 Is Accounts Receivable a Debit or Credit?

✅ Accounts Receivable is a Debit.

Here’s why:

Accounts receivable represents money your customers owe you, which is an asset.

In accounting, assets increase with debits and decrease with credits.

So when you make a sale on credit:

- You debit accounts receivable (to show someone owes you).

- You credit sales (to record income earned).

Example Journal Entry:

| Account | Debit ($) | Credit ($) |

|---|---|---|

| Accounts Receivable | 1,000 | |

| Sales Revenue | 1,000 |

📘 Explanation:

You record the $1,000 as receivable (debit) because you’re expecting to receive that amount from your customer later.

⚖️ The Key Difference Between Debit and Credit in Accounts Receivable

| Feature | Debit Side | Credit Side |

|---|---|---|

| Meaning | Money owed to you | Money you owe to others |

| Used For | Assets & Expenses | Liabilities & Revenues |

| Accounts Receivable | Increases (Debit) | Decreases (Credit) |

| Example Entry | Debit: Accounts Receivable | Credit: Sales Revenue |

| Effect on Balance Sheet | Increases Assets | Decreases Assets |

Quick Tip to Remember:

👉 If money is expected to come IN — it’s a debit.

👉 If money is going OUT — it’s a credit.

❌ Common Mistakes and How to Avoid Them

- Mistake: Recording accounts receivable as a credit.

- ❌ Wrong: Credit Accounts Receivable

- ✅ Correct: Debit Accounts Receivable

- Mistake: Thinking AR means money you owe.

- Tip: It’s the opposite — AR = money others owe you.

- Mistake: Forgetting to record payment received.

- When customers pay, you credit accounts receivable (to reduce it) and debit cash (because you received money).

🕹️ When to Use Debit for Accounts Receivable

You use Debit when:

- You make a sale on credit.

- A customer owes you money.

- You increase your asset balance (what’s owed to you).

🧾 Examples:

- Sold goods worth $500 on credit → Debit AR $500.

- Sent an invoice to a client → Debit AR.

- Customer promises to pay next week → Debit AR.

- Provided a service but haven’t been paid → Debit AR.

💡 Memory Hack:

“Debit = Due to me.”

If it’s due to you, it’s a debit.

💳 When to Use Credit for Accounts Receivable

You use Credit when:

- The customer pays the invoice.

- You receive the money and need to reduce AR.

- You record bad debt (customer won’t pay).

🧾 Examples:

- Customer pays $500 cash → Credit AR $500.

- You write off uncollectible account → Credit AR.

- Payment received later → Debit Cash, Credit AR.

💡 Memory Tip:

“Credit = Collected.”

Once the customer pays, you credit accounts receivable to show the money is collected.

🧮 Quick Recap: Accounts Receivable – Debit or Credit?

- ✅ Accounts Receivable = Debit (Asset increases)

- ❌ Credit only when payment is received or written off

- 💰 Debit = Due from customers

- 🏦 Credit = Collected or canceled

- 🔁 Debit when you sell, Credit when you get paid

📚 Advanced Tip: Formal Accounting View

In accounting, Accounts Receivable appears on the Balance Sheet under Current Assets.

It shows how much your customers owe your business within a short time (usually under 12 months).

In double-entry accounting:

- Debit increases your assets (like cash or AR).

- Credit increases income or liabilities.

This system keeps your books balanced — total debits always equal total credits.

✏️ Mini Quiz: Test Your Understanding

Fill in the blanks!

- Accounts receivable represents money _______ to your business.

- Accounts receivable is a _______ (debit/credit) account.

- When a customer pays, you _______ accounts receivable.

- “Debit = money coming ___.”

- “Credit = money going ___.”

(Answers: owed, debit, credit, in, out)

❓ Frequently Asked Questions (FAQs)

1. Is accounts receivable a debit or credit?

Accounts receivable is a debit because it represents money owed to your business — an asset that increases with a debit entry.

2. Why is accounts receivable considered an asset?

Because it’s future cash that your business will receive from customers, making it part of your total assets.

3. When do you credit accounts receivable?

When a customer pays or when you write off bad debts. This reduces the amount owed to you.

4. What happens to accounts receivable when you get paid?

You debit cash (increase cash) and credit accounts receivable (decrease AR).

5. Is accounts receivable an expense?

No. It’s not an expense — it’s an asset because it’s money your customers owe you.

🏁 Conclusion

So, is accounts receivable a debit or a credit?

✅ It’s a debit because it increases your assets and shows money owed to you.

Understanding the debit and credit rule makes accounting much simpler — once you remember that debits bring money in and credits send money out, everything clicks!

Keep practicing small examples daily, and soon you’ll handle balance sheets with confidence — for real!

Mira Loxley is a passionate language and writing expert at Definevs.com, turning tricky words and grammar into clear, engaging guides for every reader.